When you look at your investment portfolio and see a big number, it feels great, right? But here’s the uncomfortable truth—that number might be lying to you. Not intentionally, of course. The real culprit is inflation. If you don’t account for it, your “impressive” returns may not be as powerful as they look on paper.

Let’s break this down in a simple, practical, and human way—so you actually understand what your money will be worth 10 or 20 years from now.

Why “Returns” Alone Don’t Tell the Full Story

Most investors obsess over returns. “My SIP gave me 12% annually!” Sounds amazing. But what if inflation during that period was 6%? Suddenly, your real growth is just 6%.

This difference between what you earn and what you can actually buy is where most investors go wrong.

Understanding the Concept of Real vs Nominal Returns

What Are Nominal Returns?

Nominal returns are the returns you see on paper—without considering inflation. Mutual fund factsheets, portfolio apps, and bank statements usually show these.

What Are Real Returns and Why They Matter More

Real returns are what truly matter. They show the actual increase in your purchasing power after adjusting for inflation. These returns tell you whether your money is genuinely growing or just running on a treadmill.

The Silent Role of Inflation in Long-Term Investing

How Inflation Eats Into Your Purchasing Power

Inflation is like termites in your wealth. You don’t notice it daily, but over years, it quietly damages your money’s strength. Something that costs ₹100 today may cost ₹250–₹300 after 20 years.

Simple Example to Understand Inflation Impact

If you earn 10% returns but inflation is 6%, your real return is only about 4%. Over 20 years, this gap can mean lakhs—or even crores—less in real value.

Why Long-Term Investors Must Adjust for Inflation

10-Year vs 20-Year Investment Reality

Inflation impact increases exponentially with time. A 10-year horizon is manageable, but a 20-year horizon without inflation adjustment is financial blindness.

Compounding Works Both Ways—Returns and Inflation

Just like returns compound positively, inflation compounds negatively. Ignoring one while celebrating the other is a recipe for disappointment.

How to Calculate the Real Value of Your Investments

Basic Formula for Inflation-Adjusted Returns

Real Return ≈ Nominal Return − Inflation Rate

While this gives a rough idea, it’s not ideal for SIPs or long-term investments with multiple cash flows.

Manual Calculation vs Smart Tools

Challenges of Manual Calculations

Manual calculations are time-consuming, prone to error, and impractical for SIP investors with monthly contributions.

Why Online Calculators Are More Practical

This is where digital tools shine. They automate complex calculations and show realistic outcomes instantly.

Using an Inflation-Adjusted Approach for SIP Investments

Why SIP Investors Often Overestimate Wealth Creation

Most SIP calculators show future value without inflation. That ₹2 crore retirement corpus may feel huge today—but won’t feel the same 20 years later.

The Role of an Inflation Adjusted SIP Calculator

Using an Inflation Adjusted SIP Calculator helps you understand the real value of your investments by factoring in rising costs of living.

This tool shows not just how much you accumulate—but what it’s actually worth in today’s money.

Step-by-Step: Calculating Real SIP Returns Over 10–20 Years

Inputs That Matter Most

-

Monthly SIP amount

-

Expected annual return

-

Investment duration

-

Expected inflation rate

Interpreting the Final Output

The result shows two values:

-

Nominal future value

-

Inflation-adjusted (real) value

Always focus on the second one—that’s your true wealth.

Real-Life Scenarios: What Your Money Is Actually Worth

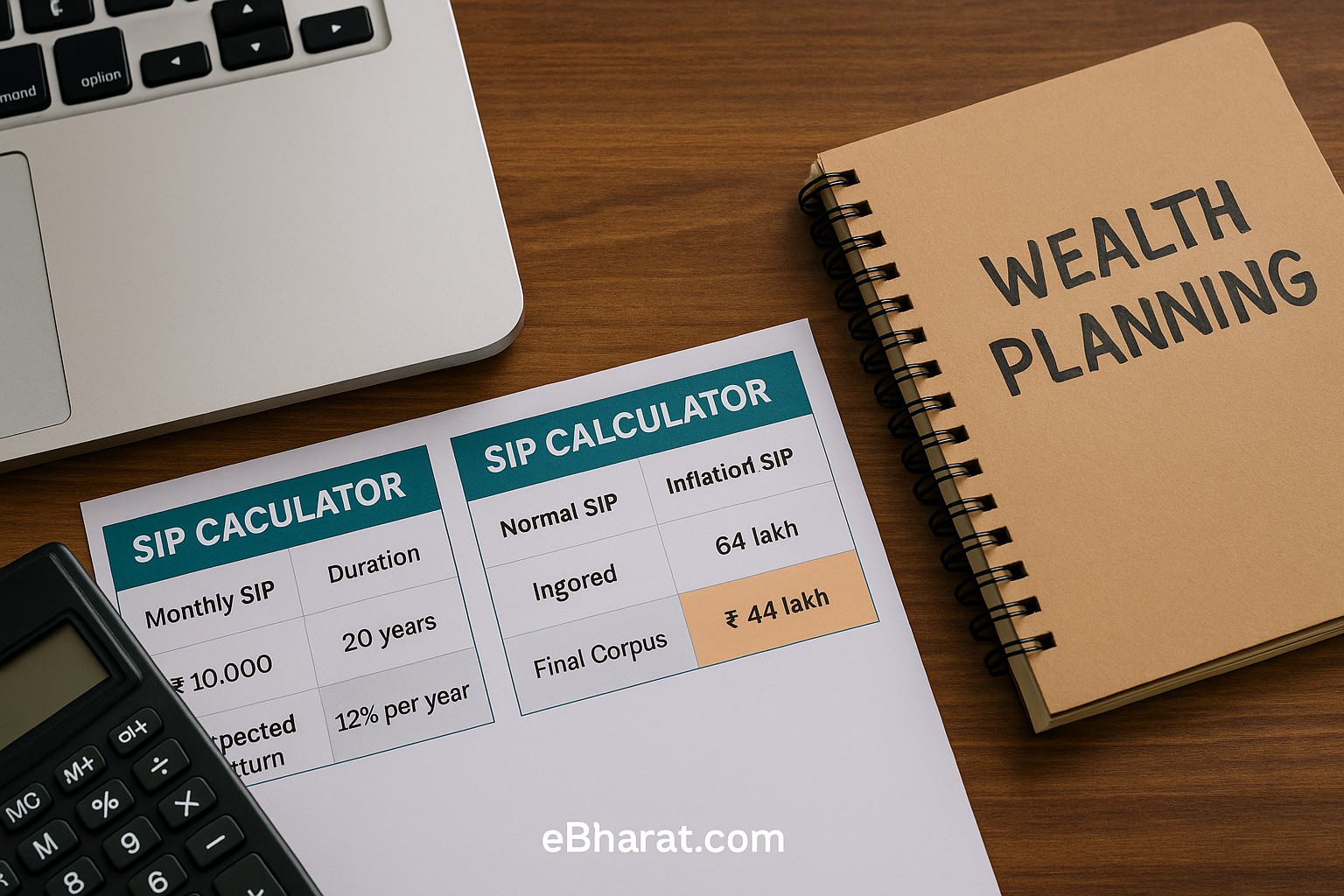

Case Study: ₹10,000 Monthly SIP for 20 Years

-

Monthly SIP: ₹10,000

-

Expected return: 12%

-

Inflation: 6%

Nominal corpus: ~₹1 crore

Real value: ~₹55–60 lakh

That’s a massive difference—and a crucial reality check.

Common Mistakes Investors Make While Calculating Returns

Ignoring Inflation

This is the biggest mistake. It creates false confidence and underprepared financial goals.

Assuming Fixed Returns

Markets are volatile. Realistic planning means using conservative, inflation-adjusted estimates.

How Inflation-Adjusted Calculations Improve Financial Planning

Retirement Planning

You don’t retire on numbers—you retire on lifestyle. Inflation-adjusted planning ensures your future lifestyle is protected.

Child Education & Long-Term Goals

Education costs rise faster than inflation. Adjusting returns helps avoid funding gaps later.

Choosing the Right Tools for Smarter Investing

Why Accuracy Matters

Wrong assumptions today can cost you years of extra work tomorrow.

Trusted Online Calculators

Always use calculators that factor inflation, not just returns. They provide clarity, not illusions.

Final Thoughts: Think in Terms of Purchasing Power, Not Just Numbers

Wealth isn’t about how much money you have—it’s about what that money can do for you. By learning how to calculate the real value of your investments over 10–20 years, you move from hopeful investing to intelligent investing.

Inflation isn’t your enemy—ignoring it is.

Conclusion

If you truly want to understand your financial future, stop looking only at returns and start focusing on real value. Inflation-adjusted calculations give you clarity, realism, and confidence. Whether you’re investing for retirement, a home, or your child’s future, knowing the true worth of your money is non-negotiable. Smart investors don’t just grow money—they protect its power.

Leave a Reply